As collectors gear up for Canada’s major art auctions later this month—Waddington’s on November 27 and Heffel on November 28—many are reflecting on industry shifts following Sotheby’s February decision to cease regular live and online auctions north of the 49th.

Some of the subsequent industry changes are easy to track. Sotheby’s vice-president/managing director Linda Rodeck returned to Waddington’s in July. At the same time, that house underwent a restructuring from its former brand Joyner Waddington’s, with Geoffrey Joyner stepping back to the role of senior advisor.

And of course, some things never change, like the tendency of one particularly expensive work to capture media attention each auction season. This fall, it’s Emily Carr’s The Crazy Stair, which is estimated at $1.2 to 1.6 million in the Heffel auction and comes from the collection of the Vancouver Club. (President David Heffel estimates he worked through several years and “four Vancouver Club presidents” to obtain the work for auction.)

Nevertheless, there are more subtle and longer-term shifts afoot in Canada’s auction and secondary market scene. Among these are the launch of a new hybrid auction house; an increasing emphasis on private sales and selling exhibitions; continued growth of online auction sales; and a surge predicted for postwar Canadian artworks.

New Auction House Marries Online & Hands-On

Consignor Canadian Fine Art opened a Toronto gallery across from the AGO this summer, launching a model new to the Canadian market—online-only auctions complemented by a year-round, bricks-and-mortar gallery space for previews, client meetings and other activities.

“We felt we could really fit, especially given the departure of Sotheby’s,” says Rob Cowley, president of Consignor, who launched the space this summer with managing director Lydia Abbott and vice-president of business development Ryan Mayberry. “We felt it was a really great time to try and introduce a new model.”

Previously, Cowley worked for over a decade at Waddington’s—spending at least 5 years as chief auctioneer—while Abbott worked at Waddington’s and Heffel. Mayberry grew up in the art business as the son of Winnipeg dealer Bill Mayberry and lauched the consignor.ca interface in early 2012. He continues to work in operations and business development at Mayberry Fine Art as well.

Cowley says his team relishes the chance to merge the reach and convenience of digital auctions with the customer-service levels and face-to-face contact of traditional auctions and galleries.

An example, Cowley says, is Consignor’s first major online auction of Canadian art, which runs from November 20 to 29 and which has been previewing since November 1.

“We’ll be previewing for 26 days—roughly 200 hours. In the past, for us, it would be usually a four-to-five day preview, about 22 hours or 25 hours”—a situation which was bad for customer service and retaining new collectors. “On a Sunday-afternoon preview you’d be helping a client and you’d have two others waiting, and you’d see people leaving,” he says. “Recently, I spent over 2 hours with a client talking about a couple of pieces.”

In its first Important Canadian Art Auction, Consignor’s lead offering is a rare portrait by Tom Thomson. The small oil on panel painting depicts Thoreau MacDonald, the son of Group of Seven member J.E.H. Macdonald, and it also includes a sketch on the reverse side. It is estimated at $200,000 to $250,000. The auction also includes contemporary post-2000 works by Kim Dorland, Dil Hildebrand, IAIN BAXTER& and Wanda Koop.

“We’ve all recognized that the barriers that may have been in place 10 years ago in terms of people purchasing art online aren’t there anymore,” Cowley says. “More and more people have familiarity with buying online, whether everyday items or items of luxury.”

Online Art Sales Continue to Grow

Indeed, mirroring trends worldwide—like Amazon’s decision to start selling fine art online this summer—Canada’s online secondary market for art is continuing to grow.

“We were pioneers of the online auction business when we launched them in 1999,” David Heffel, president of Heffel Fine Art Auction House, says. “Our first sale grossed a little over $10,000 in 1999, and now we’re on target to exceed our online sales forecast [for this year] of $6 million.”

Waddington’s also has frequent online auctions. This fall, it’s conducting an online auction of Canadian art in parallel with its live auction. Where the live auction runs November 27 with previews November 24 to 27, the online auction runs from November 25 to December 5, with selected lots previewing November 24 to 27 as well.

Troy Seidman is founder of Caviar 20, a Toronto-based online retailer of design objects and secondary-market contemporary artworks. Though he has a showroom and has done some fairs, like Art Toronto and New York’s International Contemporary Furniture Fair, he’s been selling almost exclusively online since 2009.

“It [selling online] has been very positive,” says Seidman. “It positions me in a way that I’m not dependent on the local market. It always surprises me where people get in touch from, whether it’s selling a large General Idea piece to someone in Brazil, or sending a Ryan McGinley to Australia.”

Seidman says that the segment of secondary-market Canadian art he’s most interested in—like works by Rodney Graham and General Idea—has interest to an audience beyond Canada, which also dovetails well with online sales.

Private Sales an Increasing Auction-House Sector

Also reflecting worldwide trends, it appears that private sales and selling exhibitions—that is, retail exhibitions mounted by auction houses—are a growing part of the secondary market for art in Canada.

“Private sales and selling exhibitions are an increasingly important part of Sotheby’s business,” Lucila Portoraro, assistant vice-president at Sotheby’s Canada, writes in an email. “In just the first nine months of 2013, Sotheby’s private sales worldwide stand at $951.2 million compared to $695.4 million for the same period last year, representing a 37% increase.”

Since ending its live auctions north of the 49th, Sotheby’s Canadian operations now focus on private sales, bringing works from Canadian collectors to international auctions, and other client services.

The company will also hold a selling exhibition of Canadian art in Sotheby’s S|2 Gallery in New York in February 2014.

“10 years ago, our interactions with a major Canadian collector might have been limited to our salesrooms in Toronto,” Portoraro writes. “Yet today, they are buying and selling in every international Sotheby’s salesroom and engaging with us through our website and other digital platforms.”

Waddington’s is also getting into selling exhibitions. It will debut its first pop-up exhibition of Gary Taxali in January 2014.

Waddington’s new pop-ups are designed complement its Concrete Contemporary Art auctions, which launched in 2012 with the aim of developing a secondary market for post-1980 Canadian art.

“I really don’t think we could do more than one of our live Concrete Contemporary Auctions every year,” says Stephen Ranger, senior specialist, contemporary art at Waddington’s. “I don’t think the market can really bear that yet. This [pop up series] is another way to keep us at the forefront of contemporary art in Canada.”

Private Galleries Seek More Public Profile

In a complementary trend to auction houses getting into private sales, some dealers long involved in private secondary-market sales are also trying to raise the public profile of their operations.

In the past couple of years, for instance, the 41-year-old Loch Gallery has run a blue-chip historical-art sale during fall auction season in November, bringing some of the highlights to Art Toronto in October as well. This year, Loch’s exhibition includes works by Jackson Pollock and Vincent Van Gogh as well as Canadian secondary-market mainstays Tom Thomson, A.Y. Jackson and William Kurelek.

Alan Loch says that for him, the departure of Sotheby’s from live auctions in Canada “is a tell-tale sign that the public auction route is not how Canadians prefer to purchase their art.”

Loch says that the advantages of private sales are that “the client can take their time to deliberate an acquisition without the pressure and hype that the auction houses try to create in hopes of getting you to spend more money.”

However, Loch admits that auction activities are needed “to help us understand what certain things are worth.”

Miriam Shiell, another dealer who operates in the secondary market—and who brought major works by Paterson Ewen and Jack Bush to Art Toronto—agrees that while private sales may be increasingly appealing to collectors, she hopes auction activity remains strong as a “flag bearer” or “Dow Jones” of the Canadian art market in general.

“If the auctions don’t get the big material sold, then the selling collector will turn back to the private market,” Shiell says. “That’s good for the dealers and good for the galleries—but I’m not sure it’s good for the market.”

That’s because “we kind of do need the auctions to be visible and fairly strong” in order to generate confidence in the Canadian art market in general, Shiell contends.

Surge in Modern Canadian Art Predicted as Historical Supplies Tighten

In terms of overall challenges to the secondary market in Canada, there is one trend affecting all operations, whether private sale or public auction—and that is the increasing scarcity of blue-chip historical artworks.

“I certainly think we are seeing less and less really top-flight historical material,” says Stephen Ranger of Waddington’s.

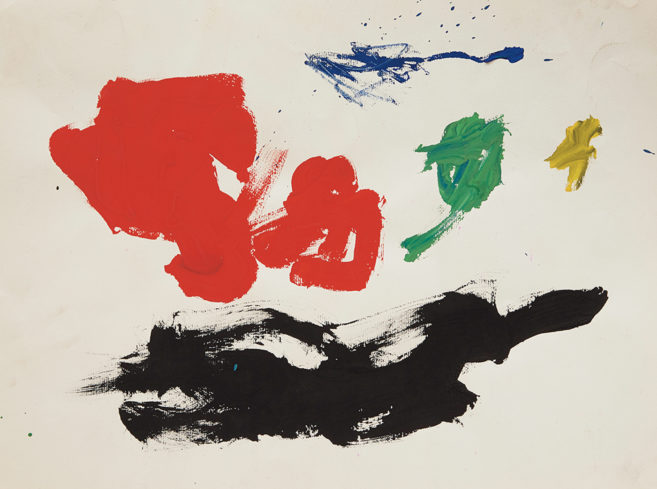

In terms of other big changes, Ranger says, “I think the modern aesthetic”—as in Jack Bush and other Painters Eleven, as well as the Automatistes—“is taking root now in a stronger way in the secondary market.”

David Heffel concurs on the latter point. “I think we will see the biggest sale totals generated from the postwar and contemporary sales,” he says. Heffel notes that in 2011, his postwar and contemporary sales outweighed his historical Canadian art sales, and he hopes this will happen again.

Jack Bush works are of particular interest in the upcoming auctions, as Christie’s in New York broke his previous auction record when they sold four Bush paintings this summer. (All four broke the previous record of $267,000, with one going for $603,750, the Globe and Mail reports.) The National Gallery of Canada will also launch a survey of Bush’s art in Fall 2014.

On the 27th, Waddington’s is offering the large Jack Bush painting June Mulberry (1972) at $225,000 to $275,000. On the 28th, Heffel is auctioning the painting Off Green (1968) estimated at $100,000 to $150,000, as well as the watercolour November #20 (Oscar’s Death) (1956) at $10,000 to $15,000.

Shiell agrees that there’s a surge of market interest in postwar Canadian art, but advises that supply may be drying up for that as well.

Looking at the case of Jack Bush, Shiell says, “30 years ago our inventories were 15 or 20 paintings. Now we are talking about 1 work at a time, or you’ve got 3 at the most. So there just isn’t the kind of availability that there used to be. People aren’t selling, they’re hanging on.”

Shiell says that this in part reflects that fact that more people in a younger generation have an appreciation for art and are more likely to keep it—rather than sell it—when they inherit.

“It used to be the kids wanted the money. Now they’re happy to keep the art, so that is making the market even scarcer,” Shiell says.

CARFAC & Select MPs Call for Artist’s Resale Right

CARFAC, an organization representing Canadian artists, is also continuing its call for the introduction of an Artist’s Resale Right in Canada. Under such a right, artists would receive a percentage of secondary-sale proceeds.

In May, CARFAC’s cause gained momentum when two MPs introduced separate bills calling for an Artist’s Resale Right to be introduced in Canada. That same month, Ritchies also announced it would pay a percentage of sales out to contemporary artists at auction, though it is unclear how much money might have been redistributed this way as of yet.

As CARFAC detailed in a recent release, 18 Inuit artists already missed out on payments this month in relation to Waddington’s sale of Inuit art on November 18. The organization notes that Cape Dorset artist Kiawak Ashoona had three sculptures that sold, including the piece Growling Polar Bear which went for $6,000.

According to CARFAC’s release, a representative from Ashoona Studios commented that if Canada had the Artist’s Resale Right, “Kiawak’s situation in the last phase of his life could be improved upon with respect to quality of life… it will certainly be a much welcomed addition to the too few resources on hand for Canada’s northern arts community.”

Asked about any potential movement on the Artist’s Resale Right at auction, Stephen Ranger of Waddington’s said, “It’s a contentious issue, and it’s as much about who is going to regulate it and how it is going to be regulated” than anything else. Saying he is “open to dialogue” with CARFAC, Ranger summed up the difficulty as being “about how it is going to be rolled out.”

This article was corrected on November 25, 2013. The original article incorrectly stated that the Consignor auction was available to preview for 2,000 hours. In actuality, it is roughly 200 hours.