Last night, Christie’s contemporary art auction in New York brought in $495 million, which the company says is the highest total of any art auction yet.

And Heffel’s spring auction in Vancouver—which also took place last night, and included the first work of video art ever sold at auction in Canada—brought in $11.5 million, surpassing pre-sale expectations.

Now, Ritchies is gearing up to return to the contemporary art auction scene in Canada—and it has made a splash by announcing it will be Canada’s first major auction house in to pay a resale commission to artists.

“Overall, I’m quite delighted,” says Grant McConnell, national president of CARFAC, the artists’ organization that has campaigned for a mandatory Artist’s Resale Right in Canada since 2010.

The mandatory Artist’s Resale Right CARFAC is proposing would ensure that visual artists in Canada to receive 5 per cent of the sale price when their work is resold. Similar measures have been adopted in some 70 other countries, including Germany, France, the UK, and Australia, though percentages and guidelines vary from place to place.

Details of Resale Commission Still in Development

Ritchies didn’t work with CARFAC on its decision, or share the information with them in advance of its royalty announcement.

Ritchies director of operations Gordon Gothreau says that when it comes to artist resale rights and royalties, “we are all familiar with the debate; there wasn’t really too much we could learn from CARFAC.”

He also said that Ritchies would rather manage the artist payments in-house than have CARFAC administrate them.

According to Gothreau, the exact percentage of the royalty payment is still being worked out and will be in place in time for Ritchies first auction of contemporary Canadian art on May 29 in Toronto.

What is confirmed is that Ritchies will make payments to both international and Canadian artists in its contemporary auction, as well as to the estates of Canadian artists.

Auction House Working to Overcome Past Problems

The artist resale commission shines a bright light on Ritchies, which was under a cloud of controversy just a few years ago.

As the Globe and Mail and Maclean’s have reported, in October 2009, Ritchies was forced into bankruptcy; later research showed that they bore an $8.5-million debt. Some 100 creditors, including consignors and landlords, were filing claims against them.

“That [2009 company] was actually a different company, technically speaking,” Gothreau says, though he admits that he was involved with both companies and that the scandal is “something we discuss with every congisnor.”

The Ritchies ownership, as Gothreau indicates, has changed completely. In 2011, the Globe reported that two investors, Kashif Khan and his partner Ravi Poddar, bought the Ritchies name from a bankruptcy trustee. In 2012, it reported that Dirk Heinze, owner of his own specialty auction house Heinze & Co., came on as president, though he left in late 2012. Since last year, the auction house has been running auctions of watches, decorative arts, and fine Canadian art, among other items.

Some in the art community might read Ritchies’ decision to pay artist royalties at its new contemporary auction as a publicity stunt—something to get them back in the news and distinguish them from more established national art-auction competitors like Heffel and Joyner Waddington’s.

“They’re welcome to read it that way,” Gothreau responds. “It’s inevitable that people are going to see it that way. And we just have to go through it, put our money where our mouth is and actually pay out the artists at the end the sale and they will see that it is something we are serious about.”

Artist Says Royalty Has Pros and Cons

Another factor Ritchies’ announcement brings to the fore is whether the contemporary Canadian art market is strong enough to sustain the addition of resale royalties.

Even an artist destined to benefit from the royalty expresses uncertainty about the issue.

One of Edward Burtynsky’s works, for instance, has been consigned to the Ritchies auction by an owner.

Burtynsky says he can see how a secondary resale royalty would benefit artists who make a very popular body of work and then change course, making work that the market doesn’t appreciate as much—so that as their auction prices for certain periods rise, they struggle to make ends meet.

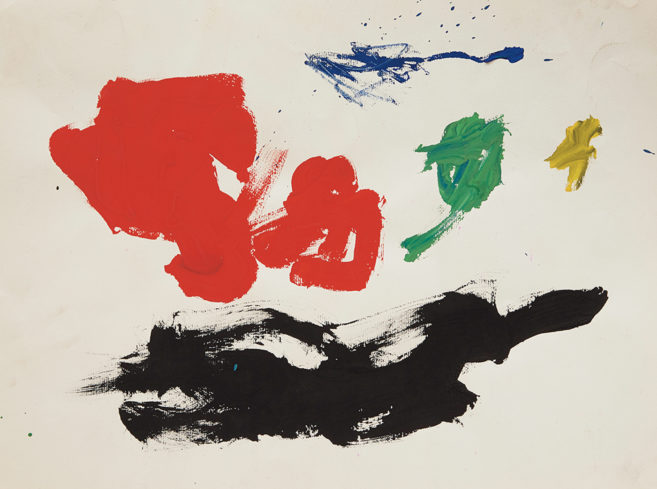

“I’m thinking about Riopelle, for instance,” Burtynsky says. “Riopelle’s 1950s period was incredible and prolific and everyone wants his 1950s works. Later he went into painting on glass, and people didn’t follow as much… he wasn’t able to benefit from the escalation of his work and the secondary market of his work and I think it would have been a great thing for [a resale right] to happen for him.”

At the same time, Burtynsky calls the Canadian art market a “pretty nascent” one and says “there’s going to be resistance in the marketplace” to an Artist Resale Right.

Burtynsky’s works have sold at auction before at Christie’s and Phillips de Pury in New York and London, as well as at auctions in Canada. If his work sells at Ritchies at the end of this month, it would be the first time he would receive a royalty on an auction sale—though he’s unsure how large it would be given the market nationally.

“My work often doesn’t even get to gallery price [at Canadian auctions], where it always gets to retail or above in London and New York,” he says. “In the Canadian market, so far, there isn’t as robust of an audience.”

Weak Spots Persist in Contemporary Canadian Art Auction Market

Burtynsky’s wonderings are in part borne out by the results of Heffel’s auction last night.

The Heffel auction achieved better than expected earnings overall, and several paintings by contemporary Canadian artists did well—including Gordon Applebe Smith’s Trees in Winter selling nearly twice as much as was estimated at $55,575, including buyers’ premium.

But the auction’s video by Judy Radul—much touted in advance as the first piece of video art to be sold at auction in Canada—sold for about half of its $5,000 to $7,000 estimate, being hammered down at $2,925 including buyers’ premium.

Similarly, Roy Arden’s Basement—the only photo work Heffel’s contemporary auction—sold for half of its low estimate. Estimated at $10,000 to $15,000, it went for $5,265 including buyers’ premium.

Nonetheless—with the Ritchies contemporary auction less than two weeks away and the house still bringing on consignors, artists included—Gothreau remains undaunted about the prospect of making it work.

“We bought the [Ritchies] name with the intention of trying to do things right—of getting the company back to where it was and then surpassing it,” Gothreau says. “Which we have been doing really, I think.”

CARFAC representatives also remain positive about the Ritchies decision.

“If there is any prosperity in the art community in Canada, some of that should reach the makers,” CARFAC’s McConnell says. “Let’s hope other auction houses follow suit.”

This article was corrected and clarified on May 16, 2013. The original copy failed to state that Dirk Heinze is no longer involved with Ritchies.

The entrance of Ritchies Auctioneers on Richmond Street West in Toronto

The entrance of Ritchies Auctioneers on Richmond Street West in Toronto