Last week, many were surprised when the Globe and Mail broke the story that Sotheby’s—a presence in the Canadian art market for more than 30 years—would be ending regular live auctions in Canada.

Sotheby’s first sale outside the United Kingdom was held in Toronto in 1967, and the company holds the record for a Canadian painting sold at auction—$5.1 million for Paul Kane’s Captain Lefroy, set in 2002.

Linda Rodeck, managing director of Sotheby’s Canada, says the decision to end regular live auctions wasn’t an easy one.

“It’s a hard decision, because we love what we do,” said Rodeck in a phone interview. “But as business people who are practically minded, we saw this was unsustainable and we had to make a change—which is, invest heavily or get out of it.”

The payoffs for Sotheby’s to invest more in Canadian art couldn’t be rationalized given the company’s much higher international revenues, Rodeck stated.

“There just isn’t a reason for us to invest more heavily in the Canadian art market, and that’s probably what it would take to gain more market share,” said Rodeck. “Remember that Sotheby’s internationally is a $7 billion a year company; Canadian art makes up just $10 million a year, while a single Mark Rothko sells for $75 million. You can see how the numbers don’t stack up globally.”

Most of the Sotheby’s Canada business, Rodeck indicated, will now be focused on “high-end private sales.” She said the possibility does exist for a one-off live auction for special cases like a particular private collection sale or similar.

The Sotheby’s decision leaves only Heffel Fine Art, based in Vancouver, and Joyner Waddington’s, based in Toronto, as regular national art auction players.

However, one of those competitors says it continues to feel optimistic about the Canadian market.

“We don’t feel that Sotheby’s decision suggests that the market for Canadian art is weak,” states Duncan McLean, president of Joyner Waddington’s, in an email. “There are lots of areas that are continuing to grow and develop. Record prices continue to be set each season.”

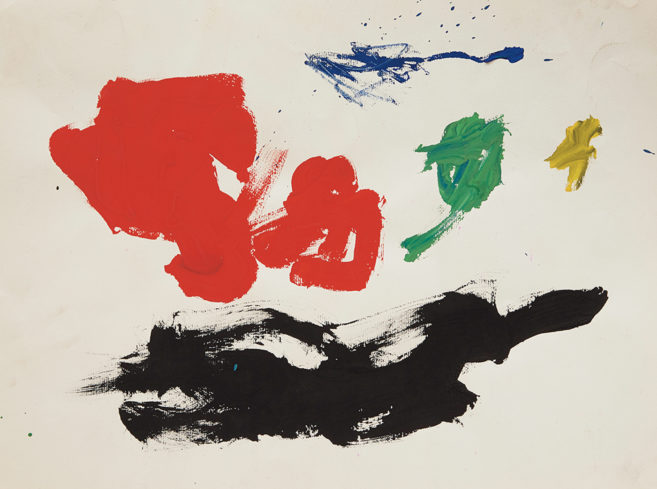

“What is happening,” McLean continued, “is that at the top level, there are fewer of the Thomsons and the Harrises that have historically been the top-selling works at auction. Our sense is that if you have a great work by Borduas, Riopelle, Lemieux or Jack Bush, you will find a strong and receptive market.”

“Sotheby’s has been a strong force in the auction business in Canada for over 30 years, so in many ways it is quite a surprise [that they have ended regular live auctions],” Duncan McLean stated.

Also, McLean notes, “we were very much buoyed by the reception Concrete Contemporary received last March, where strong prices were realized for artists whose work had never traded before at auction.”

Indeed, Joyner Waddington’s is forging ahead with its contemporary Canadian art auctions, with its next instalment due to take place March 5. That auction will feature art by Michael Snow, Kent Monkman and Katie Pretti, among other artists.

Though there were no layoffs per se at Sotheby’s as a result of its live-auction decision, some people who left for other positions over the past year were not replaced. Rodeck said that five people will continue to staff the Canadian operation.

The Sotheby's Canada offices on Hazelton Avenue in Toronto.

The Sotheby's Canada offices on Hazelton Avenue in Toronto.